The Graph Price Prediction 2022-2031: Is GRT a Good Investment?

The Graph Price Prediction 2022-2031

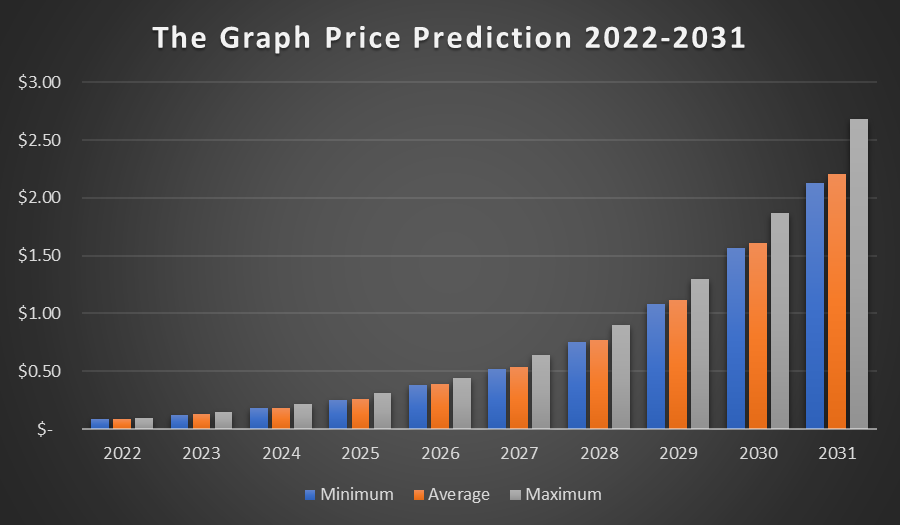

- The Graph Price Prediction 2022 – up to $0.091

- The Graph Price Prediction 2025 – up to $0.31

- The Graph Price Prediction 2028 – up to $0.90

- The Graph Price Prediction 2031 – up to $2.68

Have you ever heard of Uniswap, Aave, Compound, Balancer, USDC, Synthetix, Sushiswap, MakerDAO, Yearn, Curve, or any popular dApps? They all functionally rely upon The Graph, which is like a combination of decentralized versions of Google, banking, social media, other service providers, and other industries. The Graph price prediction could be the light that shines in this crypto winter.

There will be thousands of blockchain networks indexed by The Graph, millions of dApps/subgraphs, and trillions of daily queries in the future. Imagine everyone using their phone to transact, refresh, and interact with media/applications requiring The Graph data. Currently, there are 10-15 layer-one blockchain networks (Ethereum, Avalanche, Solana, Polygon, and others) and hundreds of popular dApps using The Graph.

Before The Graph (GRT) existed, developers who wanted to create decentralized apps needed to index all of Ethereum’s data manually, which could take multiple developers months-years minimum to complete. The Graph indexes the previously unorganized blockchain data and makes it organized and more accessible for developers to create applications.

Today’s The Graph price is $0.094971 USD with a 24-hour trading volume of $112,253,923. The Graph is up 7.01% in the last 24 hours. The current CoinMarketCap ranking is #70, with a live market cap of $655,300,906. It has a circulating supply of 6,900,000,000 GRT coins and a max. supply of 10,057,044,431 GRT coins.

This guide provides pertinent information about the network, the Graph price today, its historical performance, and its prospects. Also, it gives a detailed Graph of technical analysis and predictions for informational purposes.

Also Read:

- The Graph price analysis: Bulls strive for recovery at $0.297. Will bears make a comeback?

- The Graph price analysis: GRT rallies to $0.167 as bulls gain 12.6 percent overnight

- Basic tips on how to stake GRT from experts

- How to Stake GRT: Basic Tips from Experts

- Web3 cryptocurrencies: Good investments for the future?

What is the Graph?

The Graph network is a decentralized data querying and indexing protocol that allows seamless data sharing across applications and the blockchain. It is the first blockchain-based querying and indexing platform in the crypto sphere. Since its inception in 2018, it has hit several billion of data queries. In April 2021 alone, the Graph processed over 20 billion data queries and has continued to gain more traction. It utilizes an ERC-20 token – GRT.

The blockchain, a decentralized database, is no doubt one of the revolutionary technologies of the modern age. It offers innumerable advantages over traditional database systems and finds application in every facet of our everyday lives. Some networks fail to quickly process and retrieve data from various apps on the network. This phenomenon is generally referred to as the “Blockchain Indexing problem.”

Like search engines’ webpage indexing, the Graph indexes data from supported blockchain networks like ETH, Arbitrum, Celo, XDAI, FANTOM, Avalanche, IPFS, BSC, Polygon, and PoA networks. The indexed data is grouped into subgraphs called publicly available APIs or open APIs accessible to developers. As of 2020, over 2300 subgraphs have been rolled out for several network participants.

After the institution of the Graph mainnet, the project created a viable environment for the absolute decentralization of Apps and ease of access to data on the blockchain. With its introduction of open APIs, developers and other participants on the network can easily create subgraphs to query, index, and fetch information for various DApps. Furthermore, the network’s functionality depends on Graph Nodes that execute a thorough scan of the blockchain’s database.

Indexing ensures that data structures about their use by DApps are defined. For efficient operations, the Graph requires the support of Indexers, Delegators, and Curators, all of whom make indexing services available to end-users, stake GRT tokens to protect the Graph network, and receive GRT tokens in reward payments. The incentivization of the contribution by developers and other participants to the network ensures that they provide accurate data and improve APIs. Also, end-users who query subgraphs get to pay GRT tokens to contributors via a gateway.

Indexers (yes, humans) create subgraphs and maintain them with the most accurate and up-to-date information. They are incentivized to do so because they receive both GRT rewards for indexing and a cut of the GRT query fees earned by the subgraphs they are indexing. dApps have already openly expressed that The Graph makes it easier to keep the indexes updated and maintained. The dApp developers don’t have to waste their time/resources to maintain their indexes. They prefer using The Graph versus drudging through the data themselves and maintaining their indexes.

The Graph offers developers cost-efficient, secure and intuitive APIs. Also, DApps can add data to the Ethereum network using smart contracts. Some of the fastest-growing DeFi platforms use the APIs provided by this network in the cryptosphere; Synthetix, Aragon, AAVE, DAOstack, Balancer, and Uniswap leverage this innovation to enhance data responsiveness.

The Graph Overview

[mcrypto id=”140410″]

The Graph (GRT) Price History

GRT is an Ethereum-based token that serves as the network’s central governance and utility token. It can be utilized for global value transfer. The holders of the tokens gain rights in the ecosystem, and rewards are issued in GRT.

The Graph price is established as GRT tokens are exchanged in the digital currency market. In addition, other specific factors that dictate the price of GRT are technical features, total supply, project roadmap, regulations, upgrades, circulating supply, mainstream use cases, investor sentiments, etc.

Use cases of the Graph (GRT) Network

The difficulty in querying data on the blockchain birthed the Graph (GRT) network, and its application is specific to this concern. The properties of the blockchain network, such as chain reorganizations, finality, and structured blocks, complicate the indexing process, making it onerous to extract accurate query outcomes from data blocks.

The Graph disentangles the process by utilizing a decentralized protocol known as subgraphs that facilitates the systematic indexing and querying of information stored on the blockchain. The Graph (GRT) creates a global API that development teams can use to streamline operations and reduce processing times. Applications built on The Graph efficiently function while maintaining their decentralization. The solution offered by this innovation has continued to gain massive traction in the crypto ecosystem, and more dApps use cases are beginning to surface.

GRT Network Developments

The Graph’s Multichain Incentive Program

On 25 August 2022, the Graph Foundation announced its next incentivization program for Indexers: Migration Infrastructure Providers (MIPS). The MIPS program bootstraps Indexers to add support for new chains on the decentralized network, enabling the migration of multi-chain subgraphs.

The program allocated 0.75% of the GRT supply (50M GRT), with 0.5% to reward Indexers who contribute to bootstrapping the network and 0.25% to migration grants for subgraph developers using multi-chain subgraphs. The program builds on the success of Mission Control, which introduced the first generation of Indexers to the network by accelerating infrastructure and network readiness.

The Graph’s Hosted Service Integrates First Cosmos Chain

The Graph’s hosted service has completed the beta integration of its 35th chain and third non-EVM network: Cosmos Hub. The implementation marks The Graph’s expansion into the Cosmos ecosystem and paves the way for many more. Beta support for the Osmosis zone in the Cosmos ecosystem is also underway!

Blockchain Devs can now query Cosmos Hub data with subgraphs easily using GraphQL. The Graph enables the developers to access blockchain data without requiring custom indexing infrastructure or relying on expensive and inefficient data indexing services that employ the value extraction and user monetization commonly found in web2 platforms.

The Graph Technical Analysis

Looking at the Graph price developments in the daily chart, graph coin is poised to witness spikes in its price in the upcoming months. On 3 November, the GRT token initiated a fresh upward rally and broke its immediate resistance level at $0.08, and continued to trade upward. According to CoinMarketCap, the current price of the Graph is trading at $0.09343 with an uptrend of 1.31% from yesterday’s price. GRT coin price is showing a very strong potential as it has been holding its upward momentum since its breakout. The Graph made an attempt to break its resistance level on 28 October but faced rejection due to several ongoing macroeconomic factors, including CPI data and interest hikes. However, the graph coin price is currently aiming for its next resistance level of $0.01.

According to our Graph technical analysis, GRT has been on a bearish trend since the crypto market crash that plunged several cryptocurrencies to the bottom level in the price chart in May. The Graph token fell from a high of $0.55 to a low of $0.08 due to the market crash. Our GRT technical analysis reveals that the digital asset is currently building a short-term bullish momentum before dropping dramatically by the end of December. GRT coin ignited its fresh and steady upward momentum on 21 October and made an intra-day high of $0.09871 on 4 November. EMA-100 and EMA-200 are forming a wide gap between them, hinting at a slight upward retracement further.

The Graph token surpassed its EMA-20 trend line and now aims for further bullish momentum in the price chart. The RSI-14 indicator is trading at a level of 64, which is an overbought region that may bring a sharp fall after a bullish movement. The current buying pressure may surge more, as indicated by SMA-14 (simple moving average) trading at 41. Moreover, the Bollinger bands are forming a huge area in the Graph price chart as the Bollinger band’s upper limit is at $0.103, acting as a strong resistance level for the Graph. If the Graph token holds a price above this level, it can soon witness a massive surge and invalidate its bearish analysis by jumping from its current value to the next resistance level of $0.17, where EMA-200 is trading.

Conversely, there is an immediate support level at $0.08; if the GRT token drops below this support level, it can initiate a sharp fall. The Bollinger band’s lower limit is at $0.075, which is a crucial support level in determining further price fluctuation of the Graph coin. A price drop below the crucial support level may plunge the GRT token hard and bring bottom levels for the coin. However, the Graph price may soon recover following the current gains of the crypto market in October. By the beginning of Q2 of 2023, the GRT coin’s price may skyrocket and bring potential returns to its investors.

The Graph Price Prediction By Cryptopolitan

The Graph Price Prediction 2022

The Graph’s price is predicted to attain a minimum price level of $0.084 by the end of 2022. The average trading price is expected to be around $0.087, and the Graph price may reach as high as $0.091.

The Graph Price Prediction 2023

In 2023, it is expected that the price of The Graph will reach a maximum price of $0.15, with an average trading price of $0.13. The Graph price may go as low as $0.12.

The Graph Price Prediction 2024

The price of the Graph is anticipated to touch a maximum price of $0.22. According to our technical analysis, the Graph price might consolidate in a price range of $0.18, keeping the minimum and average price constant.

The Graph Price Prediction 2025

In 2025, it is expected that the maximum price of 1 Graph token will be equivalent to $0.31. The average trading price of the Graph is expected to be around $0.26 in 2025. The Graph price can touch the bottom at $0.25.

The Graph Price Prediction 2026

The price of The Graph is expected to attain a high of $0.44, with an average price of $0.39. It is anticipated the Graph price will trade at a minimum level of $0.38

The Graph Price Prediction 2027

The Graph may continue its bullish momentum and is anticipated to touch a maximum price of $0.64, with an average trading price of $0.54. The Graph may hit as low as $0.52 by the end of 2027.

The Graph Price Prediction 2028

In 2028, the price of the Graph is expected to reach a maximum price of $0.90, with an average trading price of $0.77. Our technical analysis reveals that the Graph may touch a minimum level of $0.75.

The Graph Price Prediction 2029

The Graph’s price is anticipated to reach a maximum price of $1.30. The average price of the Graph is predicted to be $1.12, with a minimum price of $1.08.

The Graph Price Prediction 2030

In 2030, it is expected that the maximum price of the Graph will be around $1.87, with an average trading price of $1.61. The Graph may touch a minimum value of $1.57.

The Graph Price Prediction 2031

In the next ten years, the crypto market will be a boon for investors as it may bring a wave to the current economic structure, which will push the Graph token upwards. The price of the Graph is projected to reach a maximum value of $2.68, with an average trading price of $2.21. The minimum trading price of the Graph is predicted to be $2.13 by the end of 2031.

The Graph Price Prediction by Wallet Investor

According to Wallet Investor’s GRT price prediction, the GRT coin can be a bad investment option if you are looking for a great return in the short term or quick investment plan, as the value of the GRT coin may decline soon. They predict that the price of the Graph may touch a value of $0.005 by the end of 2023. In 2025, the value of the Graph may decline more and trade at $0.001.

The Graph (GRT) Price Prediction by Trading Beast

The GRT price prediction by Trading Beast looks promising as the website predicts a bullish value for the Graph. According to them, the Graph price is expected to reach $0.0967128 by the beginning of January 2023. The expected maximum price is $0.1208910, and the minimum price is $0.0822059. The Graph price prediction for the end of the month is $0.0967128. In 2025, the Graph price will witness more surges in its price as it can touch a maximum price of $0.2652602 and a minimum price of $0.1803769, with an average trading value of $0.2122081.

The Graph Price Prediction by DigitalCoinPrice

DigitalCoinPrice predicts a bullish price movement for the Graph in the future as the price of GRT is expected to surpass the price level of $0.40. By the end of the year, the Graph is expected to reach a minimum value of $0.37. In addition, the GRT price is capable of getting a maximum value of $0.44.

The Graph Price Prediction by Market Sentiments

The high price fluctuation of the GRT token has attracted several crypto analysts and strategists to present their opinions on its future price movements. A popular YouTuber, Mr Legend Crypto, predicts that the Graph token may witness a significant bull run in the near future. He predicts that the GRT coin may surpass its all-time high and build a road to $10.

The Graph Price Predictions by Industry Influencers

Clinix Crypto Youtube channel analyzes the GRT resistance and support levels. The presenter places the next price target between $0.115 and $0.1175 and notes that Bitcoin’s performance will likely affect GRT. In the worst-case scenario, GRT will drop to $0.09.

Conclusion

The developing team behind the Graph project is constantly acquiring partnerships and actively working on adding more integrations to the network. According to some experts, the Graph token will likely bring a ray of optimistic hopes to its long-term investors as it has a bright future ahead due to its robust fundamentals in the crypto space. The Graph token may even surpass $20 if it follows positive market sentiments and brings more use cases to the crypto community.

However, the future price movement of GRT coins will solely depend on the market’s favorability and users’ adoption of the network worldwide. Cryptopolitan advises investors to do their own research and conduct experts’ opinions and investment advice before investing in the highly volatile crypto market.

GRT is finding support at an incredibly oversold level, making it a fairly decent entry point for a trade. Altcoins have been viciously targeted since early April when $GRT lost 70% of its value in such a short period of time.

Nonetheless, The Graph coin price prediction indicates that the GRT cryptocurrency has a promising future. With the GRT market and all virtual currencies reaching new heights, we may see GRT prices climb in the future. Please do your own diligence before investing in any cryptocurrency, including GRT.

from Price Prediction – Cryptopolitan https://ift.tt/9SpIB4X

Comments

Post a Comment